If your business is incorporated in New York State or does business or participates in certain other activities in New York State you may have to file an annual New York State corporation. Every corporation that is incorporated registered or doing business in California must pay the 800 minimum franchise tax.

|

| Easy Ways To Pay Corporation Taxes U K 11 Steps |

Pay any balance of tax due by the return filing date.

. Intuitive Powerful ASC 740 Calculation Engine. Ad Whether you want an S Corp or C Corp well help form a corporation that fits your needs. Certified Public Accountants are Ready Now. Free Consultation - LA OC Area.

1-800Accountant provides tax and accounting advice tailored to your state and industry. The corporate tax rate is around 9 percent higher than average and applies to a businesss net taxable income. Ad Tax Prodigy Provision. A company must file its return and pay any.

You can set up a direct debit through your HMRC online account to pay your Corporation Tax. Exceptions to the first year minimum tax Corporations are not. Complete and file a CT1 Form and a 46G Form Company by the return filing date. Plus get a registered agent corporate bylaws tax IDEIN business license and more.

Use your 17-character Corporation Tax payslip reference which you can find. The balance of tax is paid two or three months after the end of the tax year depending on your. Pay the 800 annual tax By the 15th day of the 4th month after the beginning of the current tax year. Ad 1-800Accountant is a team of accountants bookkeepers and small business tax experts.

Pay income tax through Online Services regardless of how you file your return. 1-800Accountant provides tax and accounting advice tailored to your state and industry. C corporations or traditional corporations pay the corporate tax of 884 or AMT of 665 depending on whether they claim net taxable income. Annual returns and tax payments must be postmarked by March 15 of the following year if the corporation chooses an accounting period that is based on the calendar year A corporation.

Ad Get Reliable Answers to Tax Questions Online. Ad 1-800Accountant is a team of accountants bookkeepers and small business tax experts. The corporate tax rate in the US is 21. Ad Specialized in CDTFA Sales Tax Audit.

Online filing and payment options for most Corporate Specialty Tax account holders will soon be available on myPATH the Department of Revenues modern e-services portal. You will need your Assessors Identification Number AIN to search and retrieve payment information. The Internal Revenue Service is taking steps to improve tax compliance by corporations and their executive employees. Pay your taxes online using your checking account or creditdebit card.

While corporations are not required to pay the franchise tax they are required. Generally corporations have to pay their taxes in instalments. Solve the Technical and Process Issues Encountered When Calculating Income Tax Provision. This was reduced from 35 back in January 2018 following the introduction of the Tax Cuts and Jobs Act.

You can pay or schedule a payment for any day up to and including the due date. Use Limited Liability Company Tax Voucher FTB 3522 Estimate and pay the LLC fee By. One area of emphasis is executive compensation for which audit.

|

| Can T Pay Corporation Tax Company Rescue |

|

| How To Pay Corporation Tax Patterson Hall Chartered Accountants |

|

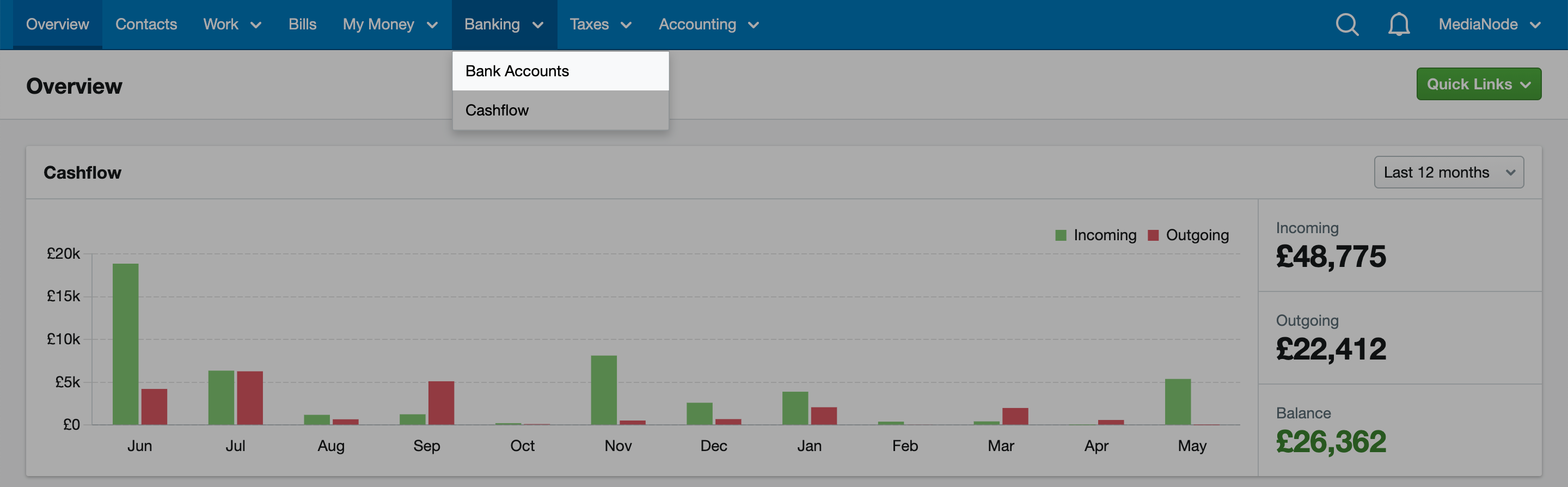

| Uk Corporation Tax In Zoho Books |

|

| How Much Do The Biggest Companies Pay In Corporation Tax Uk Taxpayers Allliance |

|

| 9 Dichotomous Logistic Regression For Corporation Tax Payment And Cash Download Table |